Intro

Discover the ins and outs of reserves management with our expert guide. Learn the top 5 things you should know about reserves, including types of reserves, reserve funding, and reserve study importance. Understand the impact of reserves on homeowners, HOAs, and community management. Get informed on reserve allocation, investments, and more.

In today's fast-paced world, having a financial safety net is crucial for individuals, businesses, and governments alike. One way to achieve this is by setting aside reserves, which can be used to cover unexpected expenses, capitalize on new opportunities, or simply provide peace of mind. However, many people are unclear about what reserves are, how they work, and why they are essential. In this article, we will delve into the top 5 things you should know about reserves.

What are Reserves?

In simple terms, reserves are funds or assets set aside for specific purposes or contingencies. These can be short-term or long-term, depending on the goals and needs of the individual or organization. For instance, a company might maintain a cash reserve to cover operational expenses during times of financial uncertainty, while a government might build up foreign exchange reserves to stabilize its currency.

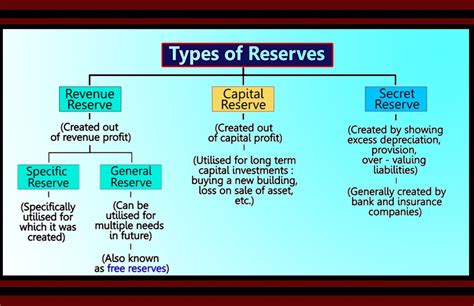

Types of Reserves

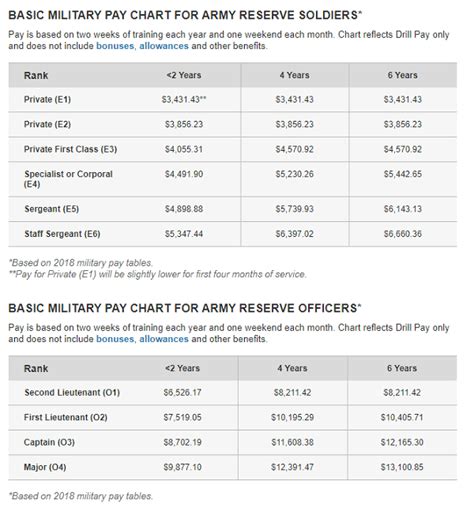

There are several types of reserves, including:

- Cash reserves: Liquid funds held in bank accounts or short-term investments.

- Equity reserves: Retained earnings or profits reinvested in the business.

- Foreign exchange reserves: Holdings of foreign currencies or assets to stabilize the exchange rate.

- Contingency reserves: Funds set aside for unexpected expenses or emergencies.

Why are Reserves Important?

Maintaining reserves is essential for several reasons:

- Risk management: Reserves can help mitigate financial risks, such as unexpected expenses or revenue shortfalls.

- Liquidity: Reserves provide a readily available source of funds, allowing individuals or organizations to take advantage of new opportunities or respond to changing circumstances.

- Creditworthiness: Holding adequate reserves can improve credit ratings, making it easier to borrow funds at favorable interest rates.

- Confidence: Having a financial safety net can instill confidence in stakeholders, including investors, customers, and employees.

Benefits of Reserves

Some benefits of maintaining reserves include:

- Improved financial stability

- Enhanced risk management

- Increased liquidity

- Better creditworthiness

- Greater confidence among stakeholders

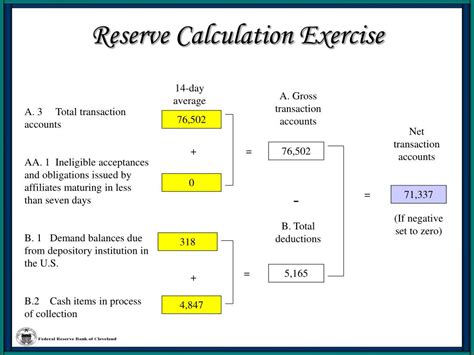

How to Calculate Reserves

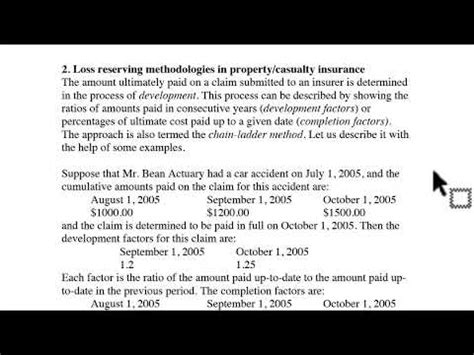

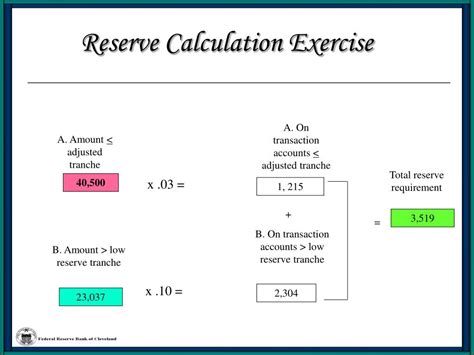

Calculating reserves involves determining the amount of funds or assets needed to achieve specific goals or cover potential expenses. This can be done using various methods, including:

- Cash flow analysis: Assessing projected income and expenses to determine the required level of cash reserves.

- Risk assessment: Identifying potential risks and estimating the funds needed to mitigate them.

- Industry benchmarks: Comparing reserve levels with industry peers or benchmarks.

Reserve Calculation Methods

Some common methods for calculating reserves include:

- Cash flow analysis

- Risk assessment

- Industry benchmarks

- Historical analysis: Reviewing past financial performance to determine reserve needs.

Common Challenges in Managing Reserves

Managing reserves can be challenging, particularly when it comes to:

- Balancing reserve levels with other financial goals, such as investing or debt repayment.

- Ensuring adequate liquidity while minimizing the opportunity cost of holding reserves.

- Maintaining transparency and accountability in reserve management.

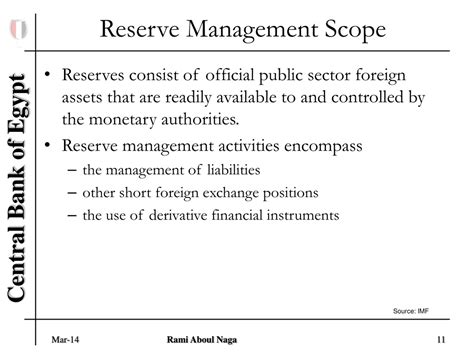

Reserve Management Strategies

Some strategies for managing reserves effectively include:

- Diversification: Spreading reserves across different asset classes or investments.

- Regular review: Periodically assessing reserve levels and adjusting as needed.

- Clear communication: Ensuring transparency and accountability in reserve management.

Best Practices for Reserve Management

To manage reserves effectively, consider the following best practices:

- Establish clear goals and objectives for reserve management.

- Regularly review and adjust reserve levels as needed.

- Diversify reserves across different asset classes or investments.

- Ensure transparency and accountability in reserve management.

Reserve Management Tools

Some tools for managing reserves effectively include:

- Cash flow forecasting software

- Risk management software

- Investment management platforms

- Regular financial reporting and review

Reserve Management Image Gallery

What is the purpose of reserves?

+Reserves are funds or assets set aside for specific purposes or contingencies, such as unexpected expenses, new opportunities, or financial stability.

How do I calculate my reserve needs?

+Reserve needs can be calculated using various methods, including cash flow analysis, risk assessment, and industry benchmarks.

What are some common challenges in managing reserves?

+Managing reserves can be challenging, particularly when it comes to balancing reserve levels with other financial goals, ensuring adequate liquidity, and maintaining transparency and accountability.

We hope this article has provided valuable insights into the world of reserves. By understanding the importance of reserves, how to calculate them, and best practices for managing them, you can make informed decisions to achieve your financial goals. Remember to regularly review and adjust your reserve levels as needed, and don't hesitate to seek professional advice if you need help managing your reserves.