Intro

Discover the importance of building reserves as a financial safety net. Learn how to calculate, maintain, and allocate reserves to ensure business stability and weather economic uncertainty. Explore the types of reserves, including cash, emergency, and contingency funds, to secure your financial future and mitigate risks. Read now and fortify your financial foundation.

In today's unpredictable economic landscape, having a financial safety net is crucial for individuals, businesses, and organizations. One key component of this safety net is reserves, which serve as a buffer against unexpected expenses, revenue shortfalls, or other financial shocks. In this article, we will delve into the world of reserves, exploring their importance, types, and best practices for managing them effectively.

The Importance of Reserves

Reserves are funds set aside for future use, typically to cover unexpected expenses, capital expenditures, or revenue shortfalls. They provide a financial cushion, allowing individuals and organizations to absorb financial shocks without compromising their financial stability. Reserves can be thought of as a financial emergency fund, which can be drawn upon during times of need.

Having adequate reserves is essential for several reasons:

- Risk management: Reserves help mitigate financial risks, such as unexpected expenses or revenue shortfalls, by providing a financial buffer.

- Financial flexibility: Reserves provide the flexibility to respond to changing financial circumstances, such as investing in new opportunities or absorbing financial shocks.

- Creditworthiness: Maintaining adequate reserves can improve creditworthiness, as lenders view reserves as a sign of financial stability and responsibility.

Types of Reserves

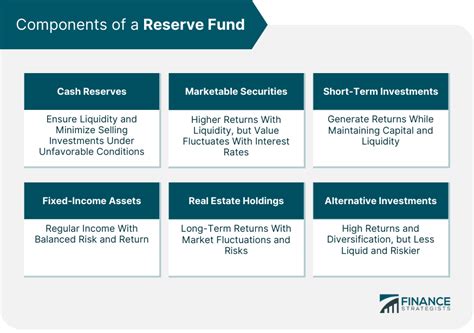

There are several types of reserves, each serving a specific purpose:

- Emergency fund: A readily accessible savings account, typically equal to 3-6 months' worth of living expenses, used to cover unexpected expenses or financial shocks.

- Capital reserve: A fund set aside for future capital expenditures, such as replacing equipment or investing in new technology.

- Revenue reserve: A fund set aside to cover revenue shortfalls or unexpected expenses, typically used by businesses or organizations.

- Strategic reserve: A fund set aside for strategic investments or initiatives, such as expanding into new markets or developing new products.

Best Practices for Managing Reserves

Effective reserve management is crucial to ensure that reserves are adequate, accessible, and aligned with financial goals. Here are some best practices for managing reserves:

- Determine reserve requirements: Assess financial risks and goals to determine the optimal reserve level.

- Set clear reserve policies: Establish clear policies and procedures for managing reserves, including funding, investment, and withdrawal guidelines.

- Monitor and review reserves: Regularly review reserve levels to ensure they remain adequate and aligned with financial goals.

- Invest reserves wisely: Invest reserves in low-risk, liquid assets to generate returns while maintaining accessibility.

- Avoid commingling funds: Maintain separate accounts for reserves to avoid commingling funds with operating accounts.

Reserve Funding Strategies

Funding reserves requires a thoughtful approach to ensure that reserves are adequately funded without compromising financial stability. Here are some strategies for funding reserves:

- Regular transfers: Set aside a fixed amount regularly, such as monthly or quarterly, to fund reserves.

- Percentage of revenue: Allocate a percentage of revenue to fund reserves, typically 5-10%.

- Surplus funds: Use surplus funds, such as year-end profits, to fund reserves.

- Asset sales: Use proceeds from asset sales, such as property or equipment, to fund reserves.

Reserve Investment Strategies

Investing reserves requires a balanced approach to generate returns while maintaining liquidity and low risk. Here are some strategies for investing reserves:

- Low-risk investments: Invest in low-risk assets, such as short-term bonds, commercial paper, or money market funds.

- Liquidity-focused investments: Invest in liquid assets, such as certificates of deposit (CDs) or treasury bills, to maintain accessibility.

- Diversification: Diversify investments to minimize risk, such as investing in a mix of short-term and long-term assets.

- Active management: Regularly review and adjust investments to ensure they remain aligned with financial goals and risk tolerance.

Investment Options for Reserves

Here are some investment options for reserves, categorized by risk level and liquidity:

- Low-risk investments:

- Short-term bonds

- Commercial paper

- Money market funds

- Certificates of deposit (CDs)

- Moderate-risk investments:

- Intermediate-term bonds

- Treasury notes

- Corporate bonds

- Higher-risk investments:

- Stocks

- Real estate investment trusts (REITs)

- Private equity funds

Reserve Management Tools and Resources

Effective reserve management requires the right tools and resources. Here are some tools and resources to help manage reserves:

- Spreadsheets: Use spreadsheets, such as Microsoft Excel, to track reserve levels, investments, and funding.

- Accounting software: Use accounting software, such as QuickBooks, to manage reserve accounts and track transactions.

- Investment management software: Use investment management software, such as Bloomberg or FactSet, to track investments and monitor performance.

- Financial advisors: Consult with financial advisors or reserve managers to provide guidance on reserve management and investment strategies.

Common Reserve Management Mistakes

Effective reserve management requires avoiding common mistakes. Here are some common mistakes to avoid:

- Inadequate funding: Failing to fund reserves adequately can leave individuals or organizations vulnerable to financial shocks.

- Poor investment choices: Investing reserves in high-risk or illiquid assets can compromise financial stability.

- Commingling funds: Commingling reserve funds with operating accounts can lead to unintended uses and compromise financial stability.

- Lack of monitoring: Failing to regularly review and monitor reserves can lead to inadequate funding or poor investment choices.

Conclusion

In conclusion, reserves are a crucial component of a financial safety net, providing a buffer against unexpected expenses, revenue shortfalls, or other financial shocks. Effective reserve management requires determining reserve requirements, setting clear policies, monitoring and reviewing reserves, and investing reserves wisely. By avoiding common mistakes and using the right tools and resources, individuals and organizations can maintain adequate reserves and ensure financial stability.

We hope this article has provided valuable insights into the world of reserves. If you have any questions or comments, please feel free to share them below.

Reserve Management Image Gallery

What is a reserve?

+A reserve is a fund set aside for future use, typically to cover unexpected expenses, revenue shortfalls, or other financial shocks.

Why are reserves important?

+Reserves provide a financial cushion, allowing individuals and organizations to absorb financial shocks without compromising financial stability.

How do I determine reserve requirements?

+Determine reserve requirements by assessing financial risks and goals, and consider factors such as emergency funding needs, capital expenditures, and revenue shortfalls.

What are some common reserve management mistakes?

+Common reserve management mistakes include inadequate funding, poor investment choices, commingling funds, and lack of monitoring.

How can I invest reserves wisely?

+Invest reserves wisely by choosing low-risk, liquid assets, such as short-term bonds, commercial paper, or money market funds, and regularly reviewing and adjusting investments.