Intro

Warning signs of an impending economic collapse are looming. Discover the 5 alarming indicators that suggest a potential downturn, including rising debt, stagnant wages, and market volatility. Stay ahead of the curve and learn how to prepare for a possible economic crisis, featuring expert analysis on recession risks and financial instability.

The threat of an economic collapse is a concern that has been on the minds of many for years. While some experts claim that the economy is on the path to recovery, others warn that a catastrophic collapse is imminent. In this article, we will explore 5 signs that may indicate the economy will collapse soon.

As we navigate the complexities of the global economy, it is essential to be aware of the warning signs that may signal a collapse. These signs can help us prepare for the worst and make informed decisions about our financial futures. Whether you are an investor, a business owner, or simply a concerned citizen, understanding these signs can help you stay ahead of the curve.

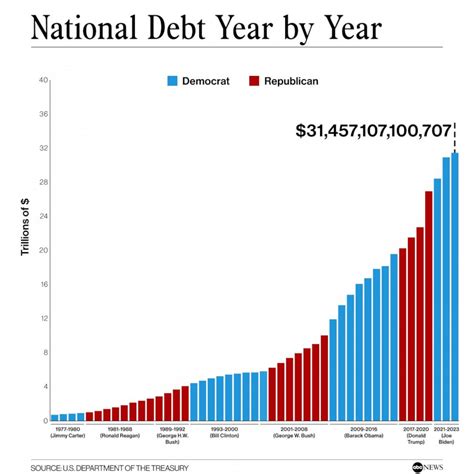

Sign #1: Increasing National Debt

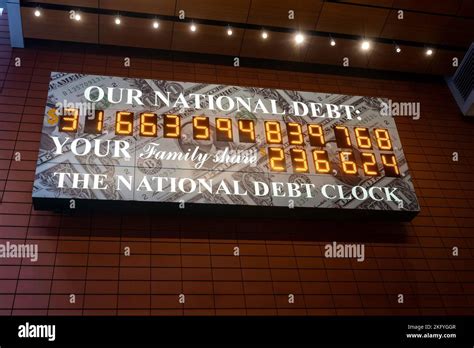

One of the most significant signs of an impending economic collapse is the increasing national debt. The national debt refers to the total amount of money owed by a country to its creditors. When a country's debt exceeds its ability to pay, it can lead to a decrease in investor confidence, higher interest rates, and a reduction in the value of the currency.

In the United States, the national debt has been steadily increasing over the years, with some projections suggesting that it will exceed $28 trillion by 2025. This staggering amount of debt can lead to a decrease in the country's credit rating, making it more difficult to borrow money and increasing the risk of default.

How Does National Debt Affect the Economy?

- Higher interest rates: As the national debt increases, interest rates may rise to attract investors and compensate for the higher risk.

- Reduced investor confidence: High levels of debt can lead to a decrease in investor confidence, causing them to seek safer investments.

- Decreased credit rating: A country's credit rating may be downgraded, making it more expensive to borrow money.

Sign #2: Stagnant Economic Growth

Stagnant economic growth is another sign that may indicate an impending economic collapse. Economic growth refers to the increase in the production of goods and services in a country over a specific period. When economic growth is stagnant, it can lead to a decrease in the standard of living, higher unemployment rates, and reduced investor confidence.

In recent years, the global economy has experienced a slowdown in growth, with some countries experiencing negative growth rates. This stagnation can be attributed to various factors, including the COVID-19 pandemic, trade tensions, and decreased consumer spending.

How Does Stagnant Economic Growth Affect the Economy?

- Decreased standard of living: Stagnant economic growth can lead to a decrease in the standard of living, as the production of goods and services remains constant.

- Higher unemployment rates: When economic growth is stagnant, it can lead to higher unemployment rates, as businesses may not be able to create new jobs.

- Reduced investor confidence: Stagnant economic growth can lead to a decrease in investor confidence, causing them to seek safer investments.

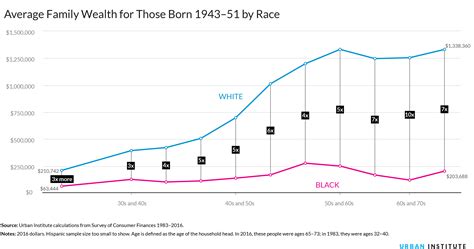

Sign #3: Increased Income Inequality

Increased income inequality is another sign that may indicate an impending economic collapse. Income inequality refers to the disparity in income between the rich and the poor. When income inequality increases, it can lead to social unrest, decreased consumer spending, and reduced economic growth.

In recent years, income inequality has been on the rise, with the wealthiest 1% of the population holding a significant portion of the world's wealth. This increase in income inequality can be attributed to various factors, including globalization, technological advancements, and decreased government regulation.

How Does Income Inequality Affect the Economy?

- Social unrest: Increased income inequality can lead to social unrest, as the poor may feel that they are being left behind.

- Decreased consumer spending: When income inequality increases, it can lead to decreased consumer spending, as the poor may not have enough disposable income.

- Reduced economic growth: Increased income inequality can lead to reduced economic growth, as the wealthy may not be investing in the economy.

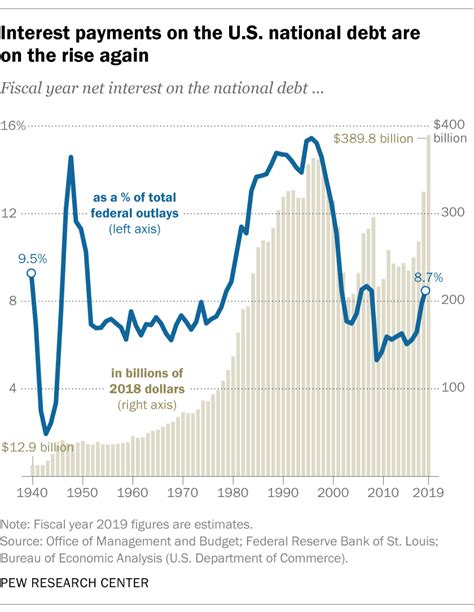

Sign #4: Over-Reliance on Debt

Over-reliance on debt is another sign that may indicate an impending economic collapse. Debt refers to the amount of money borrowed by individuals, businesses, and governments. When debt levels become too high, it can lead to a decrease in investor confidence, higher interest rates, and a reduction in the value of the currency.

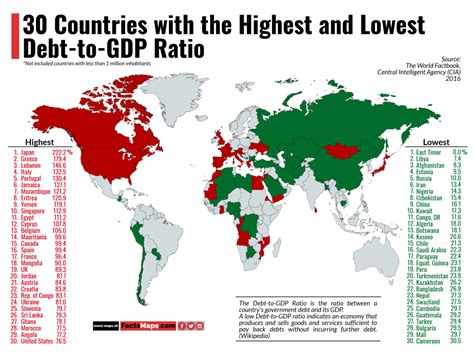

In recent years, debt levels have been on the rise, with some countries experiencing debt-to-GDP ratios of over 100%. This over-reliance on debt can be attributed to various factors, including government spending, consumer borrowing, and business loans.

How Does Over-Reliance on Debt Affect the Economy?

- Decreased investor confidence: High levels of debt can lead to a decrease in investor confidence, causing them to seek safer investments.

- Higher interest rates: When debt levels become too high, interest rates may rise to attract investors and compensate for the higher risk.

- Reduced economic growth: Over-reliance on debt can lead to reduced economic growth, as the debt burden can become too high to manage.

Sign #5: Unstable Financial Markets

Unstable financial markets are another sign that may indicate an impending economic collapse. Financial markets refer to the platforms where financial assets are traded, such as stocks, bonds, and currencies. When financial markets become unstable, it can lead to a decrease in investor confidence, higher volatility, and reduced economic growth.

In recent years, financial markets have experienced increased volatility, with some markets experiencing significant fluctuations in value. This instability can be attributed to various factors, including global events, economic indicators, and market speculation.

How Do Unstable Financial Markets Affect the Economy?

- Decreased investor confidence: Unstable financial markets can lead to a decrease in investor confidence, causing them to seek safer investments.

- Higher volatility: When financial markets become unstable, it can lead to higher volatility, causing investors to lose money.

- Reduced economic growth: Unstable financial markets can lead to reduced economic growth, as investors may become risk-averse.

In conclusion, while these signs do not necessarily mean that an economic collapse is imminent, they do indicate that the economy is facing significant challenges. By understanding these signs, we can prepare for the worst and make informed decisions about our financial futures.

Economic Collapse Image Gallery

What are the signs of an economic collapse?

+The signs of an economic collapse include increasing national debt, stagnant economic growth, increased income inequality, over-reliance on debt, and unstable financial markets.

How does national debt affect the economy?

+National debt can lead to higher interest rates, decreased investor confidence, and reduced economic growth.

What are the consequences of stagnant economic growth?

+Stagnant economic growth can lead to decreased standard of living, higher unemployment rates, and reduced investor confidence.