Intro

Maximize your military benefits with these 7 financial tips. Learn how to navigate military pay, taxes, and investing to achieve financial stability. Discover strategies for managing debt, building credit, and saving for retirement. Get expert advice on military finance, Veterans Affairs benefits, and more to secure your financial future.

As a member of the military, managing your finances can be a challenging task. With frequent deployments, changing income, and unique financial benefits, it's essential to have a solid understanding of personal finance to make the most of your military compensation. Here are 7 financial tips specifically designed for military personnel:

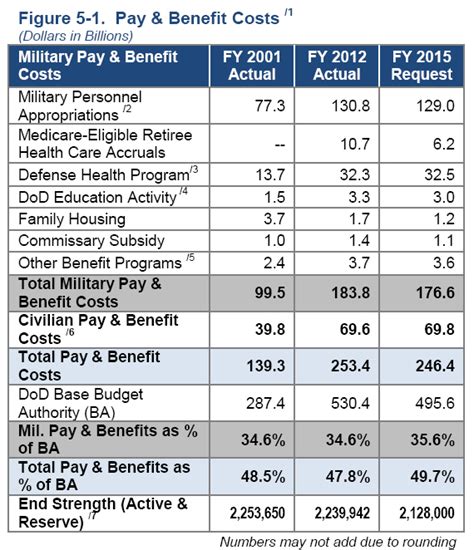

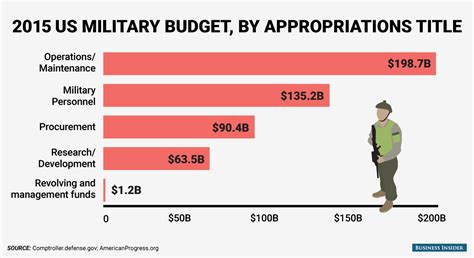

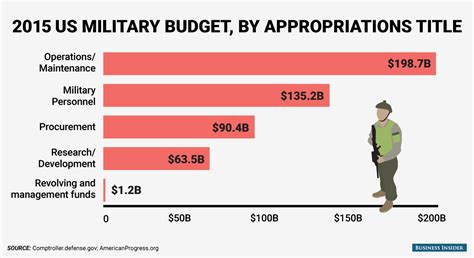

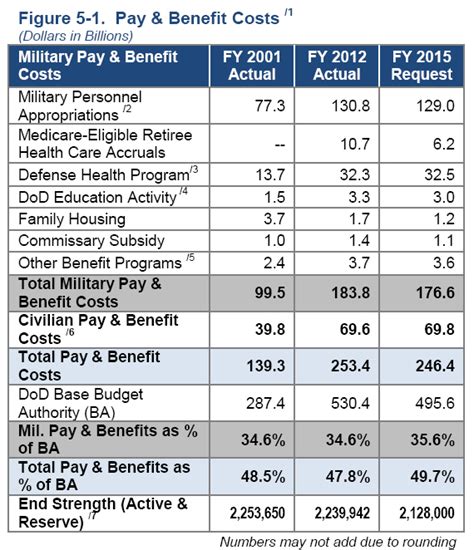

Understand Your Military Pay and Benefits

As a military personnel, you receive a unique compensation package that includes basic pay, allowances, and special pays. It's essential to understand how your pay is structured and what benefits you're eligible for. Familiarize yourself with the military pay charts and understand how your pay will change over time.

Take Advantage of Tax-Free Allowances

As a military personnel, you're eligible for tax-free allowances, such as Basic Allowance for Housing (BAH) and Basic Allowance for Subsistence (BAS). These allowances can help reduce your taxable income, resulting in lower taxes. Make sure to take advantage of these allowances to minimize your tax liability.

Create a Budget and Track Your Expenses

Creating a budget is essential for managing your finances effectively. Start by tracking your income and expenses to understand where your money is going. Make a budget that accounts for your military pay, allowances, and expenses. You can use the 50/30/20 rule as a guideline to allocate your income towards necessities, discretionary spending, and savings.

Pay Off High-Interest Debt

High-interest debt, such as credit card debt, can be a significant financial burden. As a military personnel, you may be eligible for special debt repayment programs, such as the Military Debt Relief Act. Take advantage of these programs to pay off high-interest debt and free up your income for more important expenses.

Build an Emergency Fund

As a military personnel, you may face unexpected expenses, such as deployments or medical bills. Building an emergency fund can help you cover these expenses without going into debt. Aim to save 3-6 months' worth of expenses in a easily accessible savings account.

Take Advantage of Military-Specific Savings Options

The military offers several savings options, such as the Thrift Savings Plan (TSP) and the Military Savings Plan. These plans offer tax benefits and employer matching contributions. Take advantage of these plans to save for retirement and other long-term goals.

Consider Using a Military-Specific Financial Advisor

As a military personnel, you may face unique financial challenges that require specialized advice. Consider using a financial advisor who has experience working with military personnel. They can help you navigate the complex world of military finance and create a personalized financial plan.

Stay Informed and Take Advantage of Military Financial Resources

The military offers several financial resources, such as the Military Financial Readiness Program and the Military OneSource website. Take advantage of these resources to stay informed about military finance and get access to personalized financial counseling.

Conclusion

Managing your finances as a military personnel requires a unique set of skills and knowledge. By following these 7 financial tips, you can make the most of your military compensation and achieve long-term financial stability. Remember to stay informed, take advantage of military-specific savings options, and seek professional advice when needed.

Military Financial Tips Image Gallery

What is the Military Debt Relief Act?

+The Military Debt Relief Act is a program that provides debt relief to military personnel who are experiencing financial difficulties due to their military service.

How do I access the Military Financial Readiness Program?

+The Military Financial Readiness Program is available to all military personnel and their families. You can access the program by visiting the Military OneSource website or by contacting your local military financial counselor.

What is the Thrift Savings Plan?

+The Thrift Savings Plan is a retirement savings plan that is available to all military personnel. The plan offers tax benefits and employer matching contributions.