Intro

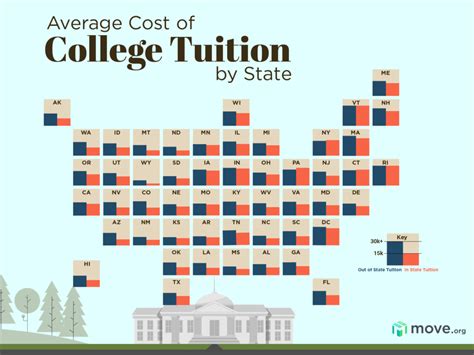

Unlock the truth behind college tuition costs. Discover the 5 surprising ways college tuition really works, including hidden fees, financial aid secrets, and cost-saving strategies. Learn how to navigate the system and make informed decisions about your higher education investments, saving you money and reducing student debt.

The cost of attending college can be overwhelming, and navigating the complex world of tuition payments can be daunting for students and their families. With the rising costs of higher education, it's essential to understand how college tuition really works. In this article, we'll break down the different aspects of college tuition, providing you with a comprehensive guide to help you make informed decisions about your educational investments.

Understanding the Components of College Tuition

The cost of attending college is not just about the tuition fee. It includes various components that can significantly impact the overall cost of attendance. Here are some of the key components of college tuition:

- Tuition: This is the fee charged by the college for instruction and other educational expenses.

- Fees: These are additional charges for services such as student health, athletic facilities, and technology.

- Room and Board: This includes the cost of living on campus, including meals and accommodations.

- Books and Supplies: Students need to purchase textbooks, course materials, and other supplies for their classes.

- Transportation: This includes the cost of commuting to and from campus, as well as any travel expenses for study abroad programs.

How Tuition Payment Plans Work

Tuition payment plans can vary depending on the college and the type of student. Here are some common payment plans:

- Semester-based payment plans: Students pay tuition fees on a semester-by-semester basis.

- Academic year-based payment plans: Students pay tuition fees for the entire academic year upfront.

- Payment plans with installment options: Students can pay tuition fees in installments over a set period.

5 Ways College Tuition Really Works

Now that we've covered the basics of college tuition, let's dive deeper into the ways it really works. Here are five key aspects to consider:

1. Tuition Discounts and Waivers

Many colleges offer tuition discounts and waivers to students who meet specific criteria. These can include:

- Merit-based scholarships: Students who achieve high grades or demonstrate exceptional talent may be eligible for merit-based scholarships.

- Need-based financial aid: Students who demonstrate financial need may be eligible for need-based financial aid.

- Tuition waivers: Some colleges offer tuition waivers to students who are employees of the college or have family members who are employees.

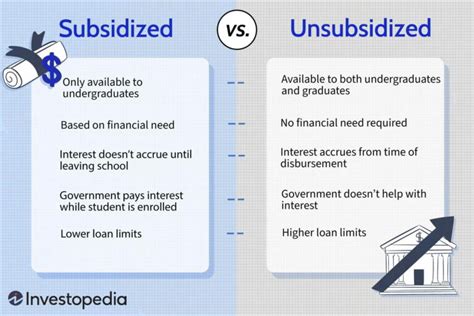

2. Federal and State Financial Aid

The federal government and individual states offer financial aid to help students pay for college tuition. This can include:

- Pell Grants: Need-based grants for undergraduate students.

- Federal student loans: Low-interest loans for undergraduate and graduate students.

- State-based financial aid: Many states offer financial aid programs for residents attending college in-state.

3. Institutional Aid

Colleges and universities also offer institutional aid to help students pay for tuition. This can include:

- Grants: Need-based or merit-based grants awarded by the college.

- Scholarships: Merit-based or need-based scholarships awarded by the college.

- Work-study programs: Students can work part-time jobs on campus to help pay for tuition.

4. Payment Plans and Installment Options

Many colleges offer payment plans and installment options to help students pay for tuition. These can include:

- Monthly payment plans: Students can pay tuition fees in monthly installments.

- Quarterly payment plans: Students can pay tuition fees in quarterly installments.

- Deferred payment plans: Students can defer payment of tuition fees until after graduation.

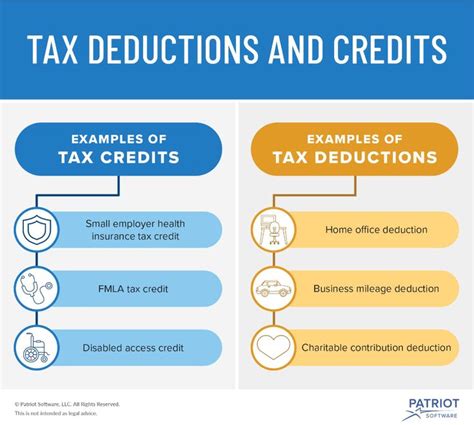

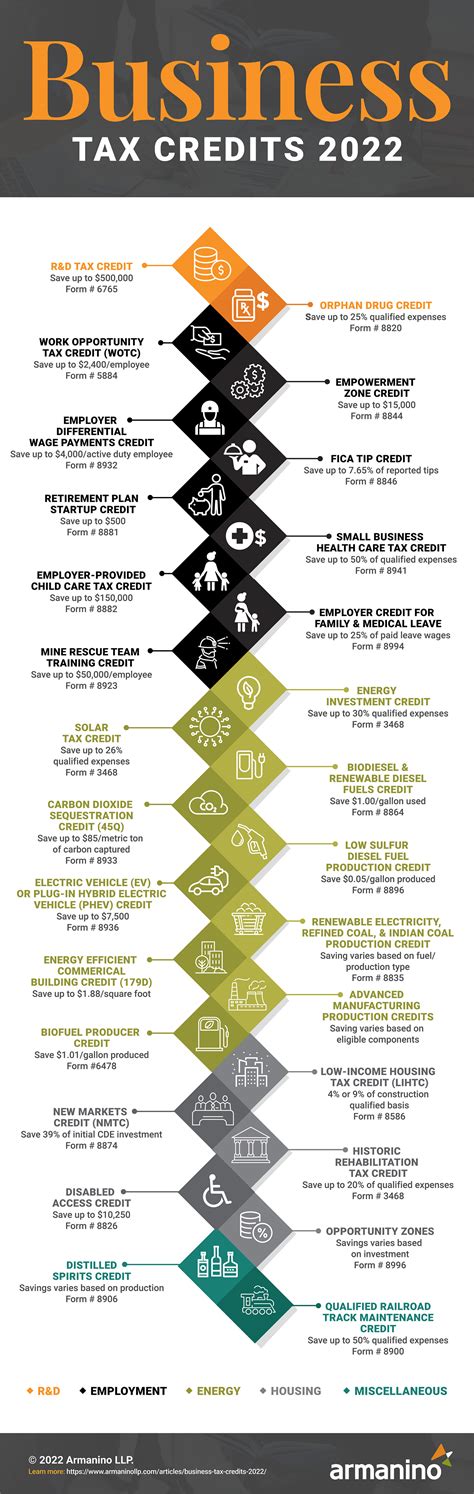

5. Tax Credits and Deductions

Finally, students and their families may be eligible for tax credits and deductions to help offset the cost of college tuition. These can include:

- American Opportunity Tax Credit: A tax credit of up to $2,500 for qualified education expenses.

- Lifetime Learning Credit: A tax credit of up to $2,000 for qualified education expenses.

- Tuition and fees deduction: Students and their families may be able to deduct tuition and fees from their taxable income.

Gallery of College Tuition Images

College Tuition Image Gallery

Frequently Asked Questions

What is the difference between tuition and fees?

+Tuition refers to the instructional costs of attending college, while fees include additional charges for services such as student health, athletic facilities, and technology.

What types of financial aid are available to students?

+Students can apply for federal and state financial aid, including Pell Grants, federal student loans, and state-based financial aid programs. Institutional aid, such as grants and scholarships, may also be available.

Can I defer payment of tuition fees until after graduation?

+Yes, some colleges offer deferred payment plans, allowing students to defer payment of tuition fees until after graduation.

In conclusion, navigating the complex world of college tuition requires a comprehensive understanding of the various components, payment plans, and financial aid options available. By exploring these aspects, students and their families can make informed decisions about their educational investments and take the first step towards achieving their academic goals.