Intro

Discover 5 Navy Federal Business Solutions, including business loans, credit cards, and online banking, designed to support business growth, cash management, and financial stability with flexible terms and competitive rates.

As a business owner, managing finances effectively is crucial for success. With so many financial institutions offering business solutions, it can be overwhelming to choose the right one. Navy Federal Business Solutions stands out as a top-notch option, providing a range of services tailored to meet the unique needs of businesses. In this article, we will delve into the world of Navy Federal Business Solutions, exploring its benefits, features, and how it can help take your business to the next level.

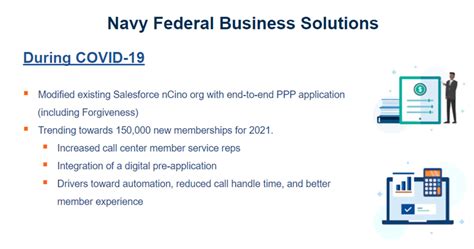

Navy Federal Business Solutions is designed to support businesses of all sizes, from small startups to large corporations. With a focus on providing personalized service, competitive rates, and innovative solutions, Navy Federal has established itself as a trusted partner for businesses. Whether you're looking to manage cash flow, finance equipment, or expand your operations, Navy Federal Business Solutions has the expertise and resources to help you achieve your goals.

The importance of effective financial management cannot be overstated. A well-managed financial system can help businesses navigate challenges, capitalize on opportunities, and drive growth. Navy Federal Business Solutions understands this and offers a comprehensive range of services, including business checking and savings accounts, loans, credit cards, and investment solutions. By leveraging these services, businesses can streamline their financial operations, reduce costs, and improve their bottom line.

Benefits of Navy Federal Business Solutions

Key Features of Navy Federal Business Solutions

Navy Federal Business Solutions offers a range of features designed to meet the unique needs of businesses. Some of the key features include: * Business checking and savings accounts with competitive rates and low fees * Loans and credit cards with flexible terms and competitive rates * Online and mobile banking solutions for easy account management * Investment solutions, including business retirement accounts and investments * Expert guidance and support from experienced business bankersHow Navy Federal Business Solutions Can Help Your Business

Types of Businesses That Can Benefit from Navy Federal Business Solutions

Navy Federal Business Solutions is designed to support businesses of all sizes and types. Some of the types of businesses that can benefit from Navy Federal Business Solutions include: * Small businesses, including startups and sole proprietorships * Medium-sized businesses, including partnerships and limited liability companies * Large corporations, including publicly traded companies * Non-profit organizations, including charities and educational institutions * Government contractors, including businesses that work with the federal governmentAdvantages of Choosing Navy Federal Business Solutions

How to Get Started with Navy Federal Business Solutions

Getting started with Navy Federal Business Solutions is easy. Some of the steps you can take to get started include: * Visiting the Navy Federal website to learn more about their business solutions * Contacting a Navy Federal business banker to discuss your business needs * Applying for a business checking or savings account online or in person * Exploring Navy Federal's loan and credit card options * Taking advantage of Navy Federal's investment solutions and expert guidanceNavy Federal Business Solutions vs. Other Financial Institutions

Common Challenges Faced by Businesses and How Navy Federal Business Solutions Can Help

Businesses often face a range of challenges, from managing cash flow to navigating complex financial regulations. Navy Federal Business Solutions can help businesses overcome these challenges by providing: * Access to capital through loans and credit cards * Expert guidance and support to help navigate complex financial regulations * Innovative online and mobile banking solutions to help manage cash flow * Investment solutions to help grow your business * Personalized service from experienced business bankersReal-World Examples of Businesses That Have Benefited from Navy Federal Business Solutions

Best Practices for Using Navy Federal Business Solutions

To get the most out of Navy Federal Business Solutions, businesses should follow best practices such as: * Regularly reviewing and updating their financial plans * Taking advantage of Navy Federal's expert guidance and support * Using Navy Federal's online and mobile banking solutions to manage cash flow and streamline financial operations * Exploring Navy Federal's loan and credit card options to access capital * Using Navy Federal's investment solutions to grow their businessNavy Federal Business Solutions Image Gallery

What types of businesses can benefit from Navy Federal Business Solutions?

+Navy Federal Business Solutions is designed to support businesses of all sizes and types, including small startups, medium-sized businesses, large corporations, non-profit organizations, and government contractors.

What are the benefits of choosing Navy Federal Business Solutions?

+The benefits of choosing Navy Federal Business Solutions include competitive rates and terms on loans and credit cards, personalized service from experienced business bankers, innovative online and mobile banking solutions, access to a range of business checking and savings accounts, investment solutions to help grow your business, and expert guidance and support to help you achieve your business goals.

How can I get started with Navy Federal Business Solutions?

+To get started with Navy Federal Business Solutions, you can visit the Navy Federal website to learn more about their business solutions, contact a Navy Federal business banker to discuss your business needs, apply for a business checking or savings account online or in person, explore Navy Federal's loan and credit card options, and take advantage of Navy Federal's investment solutions and expert guidance.

What types of loans and credit cards are available through Navy Federal Business Solutions?

+Navy Federal Business Solutions offers a range of loan and credit card options, including business loans, lines of credit, credit cards, and equipment financing.

How can I manage my business finances using Navy Federal Business Solutions?

+You can manage your business finances using Navy Federal Business Solutions by taking advantage of their online and mobile banking solutions, using their business checking and savings accounts, exploring their loan and credit card options, and utilizing their investment solutions and expert guidance.

In conclusion, Navy Federal Business Solutions is a comprehensive financial solution designed to support businesses of all sizes and types. With its range of services, including business checking and savings accounts, loans, credit cards, and investment solutions, Navy Federal Business Solutions can help businesses manage their finances, access capital, and achieve their goals. By choosing Navy Federal Business Solutions, businesses can benefit from competitive rates and terms, personalized service, and innovative online and mobile banking solutions. If you're looking for a trusted partner to help you navigate the complex world of business finance, consider Navy Federal Business Solutions. We invite you to share your thoughts and experiences with Navy Federal Business Solutions in the comments below, and don't forget to share this article with your network to help other businesses succeed.