Intro

Maximize savings with Navy Federal CDs tips, including high-yield certificates, term lengths, and dividend rates, to optimize your investment strategy and earn competitive returns.

The world of banking and investments can be overwhelming, especially when it comes to choosing the right options for your financial goals. One popular choice among individuals is certificates of deposit (CDs), which offer a low-risk way to earn interest on your savings. Navy Federal Credit Union, in particular, is a well-established institution that provides its members with a range of CD options. If you're considering opening a Navy Federal CD, here are some essential tips to keep in mind.

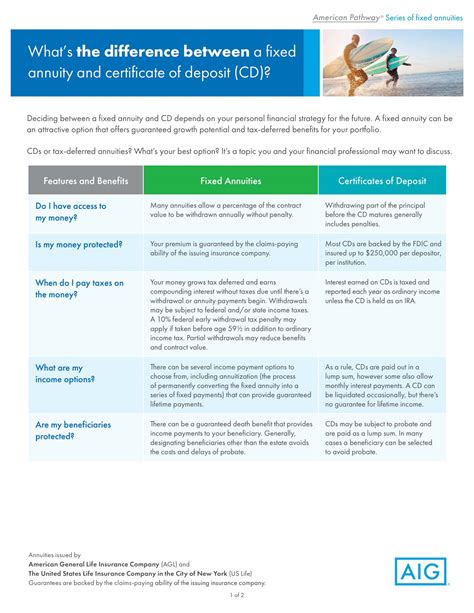

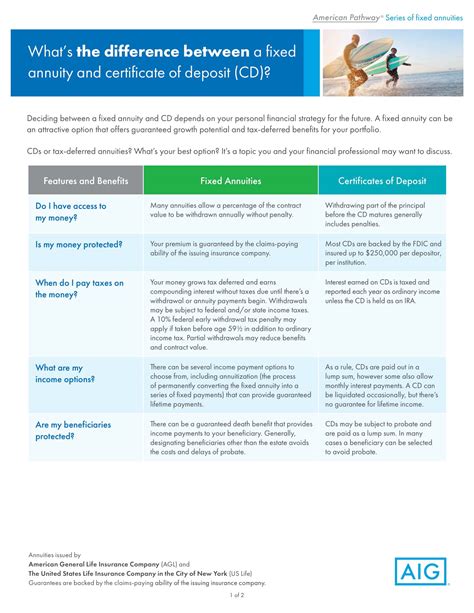

When it comes to Navy Federal CDs, it's crucial to understand the different types of CDs available, as each has its unique benefits and drawbacks. For instance, traditional CDs offer a fixed interest rate for a specified term, usually ranging from a few months to several years. On the other hand, jumbo CDs require a higher minimum deposit but often come with higher interest rates. Understanding the various CD options will help you make an informed decision that aligns with your financial objectives.

Navy Federal CDs are known for their competitive interest rates and flexible terms, making them an attractive option for those looking to grow their savings. However, it's essential to weigh the pros and cons of each CD type before making a decision. For example, while a longer-term CD may offer a higher interest rate, you'll need to keep your money locked in the CD for the entire term to avoid early withdrawal penalties. By carefully considering your financial goals and needs, you can choose the Navy Federal CD that best suits your situation.

Benefits of Navy Federal CDs

Navy Federal CDs offer several benefits that make them an excellent choice for savers. One of the primary advantages is the competitive interest rates, which can help your savings grow over time. Additionally, Navy Federal CDs are insured by the National Credit Union Administration (NCUA), providing an extra layer of security for your deposits. Furthermore, Navy Federal offers a range of CD terms, from short-term to long-term, allowing you to choose the one that best fits your financial goals.

Some of the key benefits of Navy Federal CDs include:

- Competitive interest rates

- Low-risk investment option

- Flexible CD terms

- Insured by the NCUA

- Easy to open and manage online

Types of Navy Federal CDs

Navy Federal offers several types of CDs, each designed to meet specific financial needs. Some of the most common types of Navy Federal CDs include:

- Traditional CDs: These CDs offer a fixed interest rate for a specified term, usually ranging from a few months to several years.

- Jumbo CDs: These CDs require a higher minimum deposit but often come with higher interest rates.

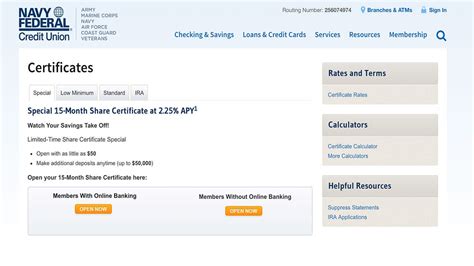

- Special CDs: These CDs offer unique benefits, such as higher interest rates or more flexible terms, for a limited time.

- IRA CDs: These CDs are designed for individual retirement accounts (IRAs) and offer tax benefits for retirement savings.

How to Open a Navy Federal CD

Opening a Navy Federal CD is a straightforward process that can be completed online or in-person at a Navy Federal branch. To get started, you'll need to:

- Become a Navy Federal member: If you're not already a member, you can join Navy Federal by meeting their eligibility requirements.

- Choose your CD type: Select the type of CD that best fits your financial goals and needs.

- Fund your CD: Deposit the required minimum amount into your CD account.

- Set your term: Choose the length of time you want to keep your money locked in the CD.

- Review and confirm: Review the terms and conditions of your CD and confirm your opening.

Navy Federal CD Rates

Navy Federal CD rates are competitive and vary depending on the type of CD and term length. Generally, longer-term CDs offer higher interest rates, while shorter-term CDs offer more flexibility. It's essential to check the current rates and terms before opening a Navy Federal CD to ensure you're getting the best deal.

Some current Navy Federal CD rates include:

- 3-month CD: 0.50% APY

- 6-month CD: 0.75% APY

- 1-year CD: 1.00% APY

- 2-year CD: 1.25% APY

- 5-year CD: 1.75% APY

Navy Federal CD FAQs

If you have questions about Navy Federal CDs, you're not alone. Here are some frequently asked questions and answers to help you get started:

- Q: What is the minimum deposit required to open a Navy Federal CD? A: The minimum deposit varies depending on the type of CD, but traditional CDs typically require a $1,000 minimum deposit.

- Q: Can I withdraw my money from a Navy Federal CD at any time? A: While you can withdraw your money from a Navy Federal CD, you may face early withdrawal penalties for doing so before the end of the term.

- Q: Are Navy Federal CDs insured? A: Yes, Navy Federal CDs are insured by the NCUA, providing an extra layer of security for your deposits.

Gallery of Navy Federal CDs

Navy Federal CDs Image Gallery

What are the benefits of opening a Navy Federal CD?

+The benefits of opening a Navy Federal CD include competitive interest rates, low-risk investment option, flexible CD terms, and insurance by the NCUA.

How do I open a Navy Federal CD?

+To open a Navy Federal CD, you need to become a Navy Federal member, choose your CD type, fund your CD, set your term, and review and confirm your opening.

What are the current Navy Federal CD rates?

+The current Navy Federal CD rates vary depending on the type of CD and term length, but you can check the current rates on the Navy Federal website or by contacting a representative.

In conclusion, Navy Federal CDs offer a low-risk way to earn interest on your savings, with competitive interest rates and flexible terms. By understanding the different types of CDs available and carefully considering your financial goals and needs, you can choose the Navy Federal CD that best suits your situation. Remember to always review the terms and conditions of your CD and ask questions if you're unsure about anything. With the right Navy Federal CD, you can grow your savings and achieve your financial objectives. We invite you to share your thoughts and experiences with Navy Federal CDs in the comments below, and don't forget to share this article with others who may be interested in learning more about this topic.