Intro

Discover expert 5 Navy Federal Life Insurance tips, including policy options, coverage, and eligibility, to make informed decisions and secure financial protection for military families and veterans with reliable insurance plans.

When it comes to protecting your loved ones and securing their financial future, life insurance is an essential consideration. For members of the military, veterans, and their families, Navy Federal Credit Union offers a range of life insurance options designed to meet their unique needs. Here are five key tips to help you navigate Navy Federal life insurance and make informed decisions about your coverage.

Life insurance can seem like a complex and overwhelming topic, but understanding the basics and exploring your options can make all the difference. By taking the time to learn about Navy Federal life insurance and how it can benefit you and your family, you can enjoy greater peace of mind and confidence in your financial planning. Whether you're just starting to explore life insurance or looking to adjust your existing coverage, these tips are designed to provide valuable insights and guidance.

From understanding the different types of life insurance available to considering your coverage needs and budget, there's a lot to think about when it comes to Navy Federal life insurance. By breaking down the process into manageable steps and focusing on your individual circumstances, you can create a tailored plan that meets your unique needs and priorities. With the right approach and support, you can make the most of Navy Federal life insurance and secure a brighter future for yourself and your loved ones.

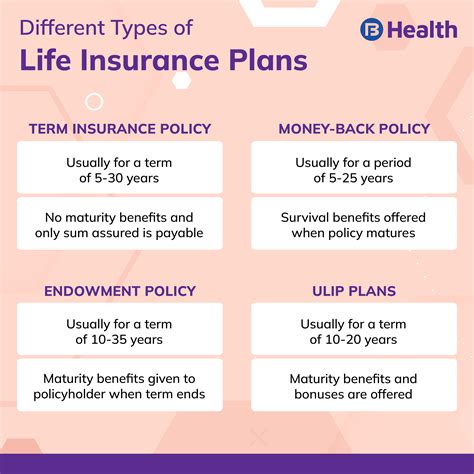

Understanding Navy Federal Life Insurance Options

Key Considerations for Choosing Navy Federal Life Insurance

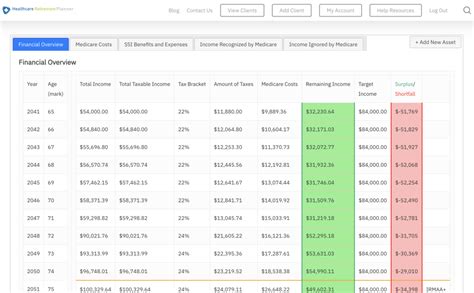

When selecting a Navy Federal life insurance policy, there are several key factors to consider. These include: * Your age and health status * Your income and budget * Your dependents and their financial needs * Your existing debt and financial obligations * Your long-term financial goals and priorities By carefully evaluating these factors and considering your individual circumstances, you can choose a Navy Federal life insurance policy that meets your unique needs and provides valuable protection for your loved ones.Evaluating Your Coverage Needs and Budget

Additional Riders and Benefits

Navy Federal life insurance policies may also offer additional riders and benefits that can enhance your coverage and provide extra protection for your loved ones. These can include: * Waiver of premium rider: This rider waives premium payments if you become disabled or critically ill. * Accidental death benefit rider: This rider provides an additional death benefit if you die as a result of an accident. * Children's term rider: This rider provides term life insurance coverage for your children. * Long-term care rider: This rider provides a portion of the death benefit to help pay for long-term care expenses. By carefully evaluating these additional riders and benefits, you can create a comprehensive life insurance plan that meets your unique needs and priorities.Applying for Navy Federal Life Insurance

Tips for a Smooth Application Process

To ensure a smooth application process, be sure to: * Gather all required documentation and information before applying * Carefully review and complete the application forms * Ask questions and seek guidance if you're unsure about any aspect of the process * Follow up with Navy Federal Credit Union to confirm receipt of your application and to address any issues that may arise By being prepared and proactive, you can help ensure a seamless application process and get the coverage you need to protect your loved ones.Managing Your Navy Federal Life Insurance Policy

Common Policy Changes and Updates

Some common changes and updates you may need to make to your Navy Federal life insurance policy include: * Updating your beneficiaries * Changing your premium payment frequency or method * Adding or removing riders and benefits * Increasing or decreasing your coverage amount * Converting your term life insurance policy to a permanent policy By understanding the types of changes you can make to your policy and how to make them, you can ensure that your coverage remains aligned with your evolving needs and priorities.Conclusion and Next Steps

Navy Federal Life Insurance Image Gallery

What types of life insurance does Navy Federal offer?

+Navy Federal offers term life insurance, whole life insurance, and universal life insurance.

How do I determine how much life insurance coverage I need?

+You can determine how much life insurance coverage you need by considering your income, debt, financial obligations, and long-term goals.

Can I add additional riders and benefits to my Navy Federal life insurance policy?

+Yes, Navy Federal life insurance policies may offer additional riders and benefits, such as waiver of premium rider, accidental death benefit rider, and children's term rider.

How do I apply for Navy Federal life insurance?

+You can apply for Navy Federal life insurance by visiting the Navy Federal website, calling the Navy Federal customer service number, or visiting a Navy Federal branch.

Can I manage my Navy Federal life insurance policy online?

+Yes, Navy Federal offers online tools and resources to help you manage your life insurance policy, including viewing your policy details, making premium payments, and updating your beneficiaries.

We hope this article has provided you with valuable insights and guidance on Navy Federal life insurance. If you have any further questions or would like to share your experiences with Navy Federal life insurance, please don't hesitate to comment below. Additionally, if you found this article helpful, please consider sharing it with others who may benefit from this information. By working together and supporting one another, we can create a brighter financial future for ourselves and our loved ones.