Intro

Discover expert 5 Navy Federal Tips for managing finances, including credit score optimization, loan guidance, and investment strategies, to enhance financial stability and security.

As a leading financial institution, Navy Federal Credit Union has been serving its members for over 80 years, providing a wide range of financial products and services. With its strong reputation and commitment to excellence, Navy Federal has become a trusted name in the financial industry. In this article, we will explore five Navy Federal tips that can help you make the most of your membership and achieve your financial goals.

Navy Federal Credit Union is known for its member-centric approach, offering personalized services and tailored solutions to meet the unique needs of its members. From savings and checking accounts to loans and credit cards, Navy Federal provides a comprehensive range of financial products that can help you manage your finances effectively. Whether you're a military personnel, a veteran, or a civilian, Navy Federal has something to offer.

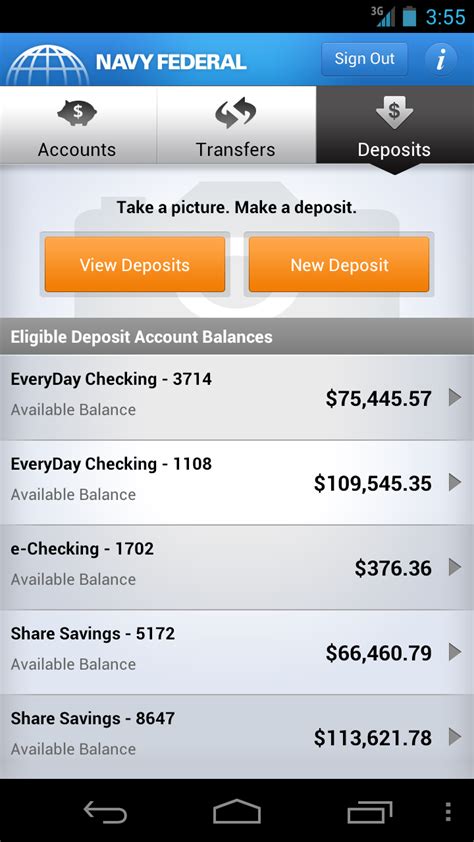

With its strong online presence and mobile banking app, Navy Federal makes it easy for members to access their accounts, pay bills, and transfer funds on the go. Additionally, Navy Federal's network of branches and ATMs provides members with convenient access to their money, wherever they are in the world. In this article, we will delve into five Navy Federal tips that can help you get the most out of your membership and achieve financial success.

Navy Federal Tip 1: Take Advantage of Membership Benefits

Navy Federal Tip 2: Use Budgeting Tools to Track Your Finances

Navy Federal Tip 3: Take Advantage of Investment Opportunities

Navy Federal Tip 4: Use Credit Cards Responsibly

Navy Federal Tip 5: Stay Safe from Financial Scams

Gallery of Navy Federal Images

Navy Federal Image Gallery

What are the benefits of being a Navy Federal member?

+As a Navy Federal member, you are eligible for a range of benefits, including discounts on loans and credit cards, exclusive offers on insurance and investment products, and competitive interest rates on savings accounts.

How can I use Navy Federal's budgeting tools to track my finances?

+Navy Federal's budgeting tools, such as its online budgeting calculator and mobile banking app, can help you track your finances, create a budget, and achieve your financial goals. You can access these tools by logging into your Navy Federal account online or through the mobile banking app.

What types of investment products does Navy Federal offer?

+Navy Federal offers a range of investment products, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). You can access these products through Navy Federal's brokerage services, which offer competitive commissions and fees.

How can I stay safe from financial scams as a Navy Federal member?

+Navy Federal offers a range of resources to help you stay safe from financial scams, including its online security center and customer service team. You can also take steps to protect yourself, such as monitoring your accounts regularly, using strong passwords, and being cautious when clicking on links or providing personal information online.

What types of credit cards does Navy Federal offer?

+Navy Federal offers a range of credit cards, including cashback rewards cards, travel cards, and secured cards. You can apply for a Navy Federal credit card by logging into your account online or visiting a branch.

In summary, Navy Federal Credit Union offers a range of products and services that can help you achieve your financial goals. By taking advantage of membership benefits, using budgeting tools, investing in a range of products, using credit cards responsibly, and staying safe from financial scams, you can make the most of your Navy Federal membership. Whether you're a military personnel, a veteran, or a civilian, Navy Federal has something to offer. We encourage you to share this article with your friends and family, and to take advantage of the resources and tools available to you as a Navy Federal member. By working together, we can achieve financial success and build a brighter future for ourselves and our loved ones.